This parameter is also available in the advanced mode.Īfter setting all parameters, you will immediately see the results in the summary table, which you can check how the accelerated option would alter the standard monthly payment.

#Paying extra biweekly mortgage calculator how to

Upfront fee - Additional upfront payment. If you would like to know how to calculate a mortgage payment on your own, the equation is the following.Mortgage points - Upfront payment as a percentage of the loan amount.This accelerated schedule will amount to one extra mortgage payment per year, and you will see how much faster you could have your loan paid off. Reverse Mortgage Guide Mortgage Info, Mortgage Payment Calculator.

#Paying extra biweekly mortgage calculator free

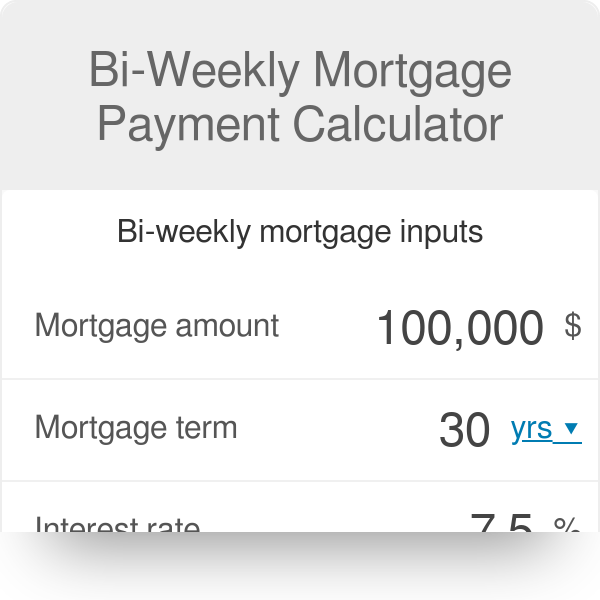

Interest rate - Yearly rate of interest or APR. This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run. Biweekly mortgage calculator with extra payments Free Excel Template Mortgage.Mortgage term - The remaining or original loan term.The payment frequency can be accelerated bi-weekly, bi-weekly mortgage, or a monthly option with overpayment. Type of acceleration - The mortgage acceleration calculator offers three ways to calculate the result. Use the 'Extra payments' functionality of Bankrates mortgage calculator to find out how you can shorten your term and save more over the long-run by paying extra money toward your loans principal.Loan amount - Either the remaining balance or, in the case of a new loan, give the original loan value.To run the mortgage acceleration calculator, you need to specify the following parameters for your mortgage loans:

0 kommentar(er)

0 kommentar(er)